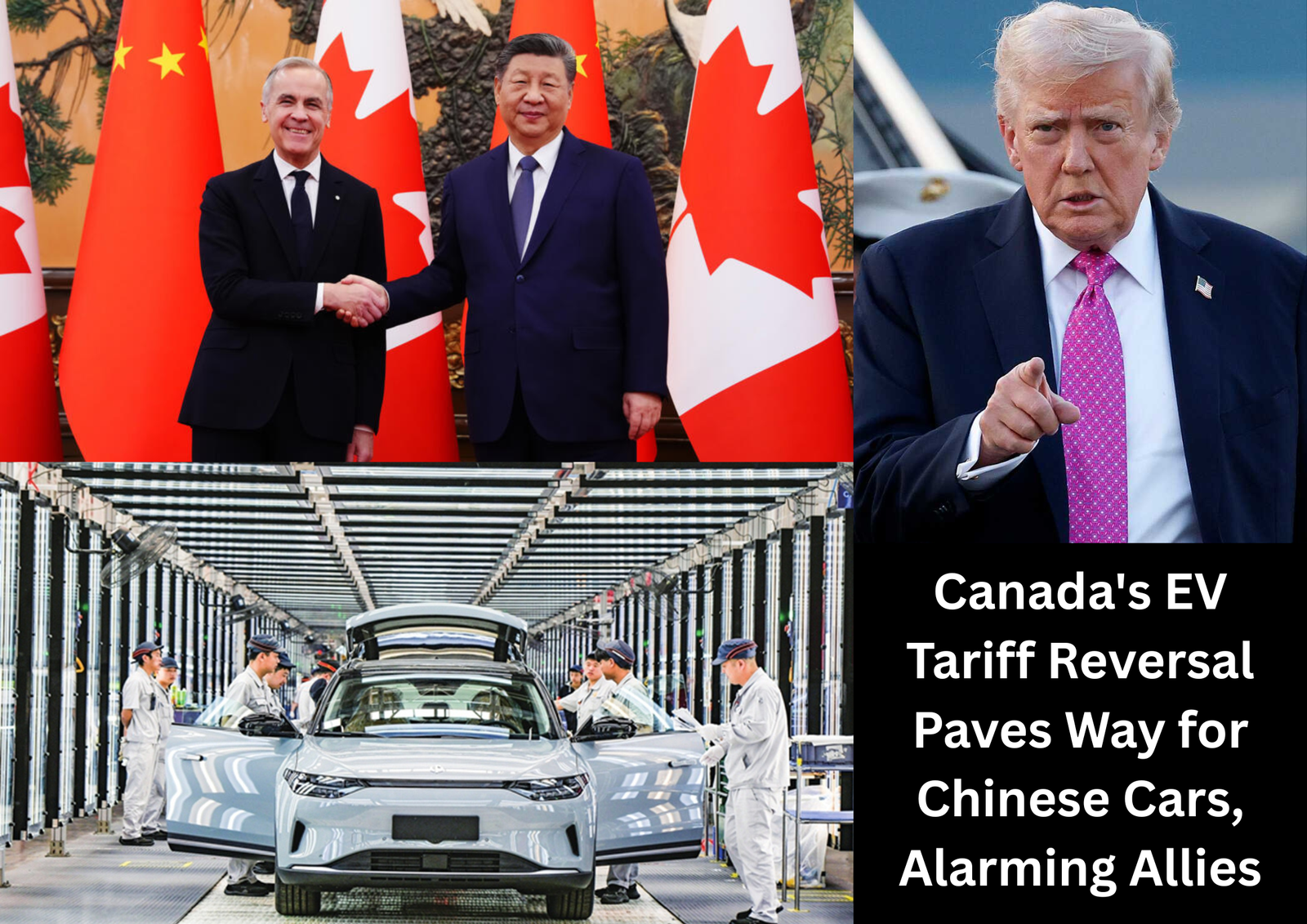

Canada has moved to dramatically ease access for Chinese electric vehicles, setting off a wave of political debate at home and frustration from key figures in Washington. Under a new bilateral agreement with Beijing, Canada will slash its 100 percent tariff on Chinese-made EVs to 6.1 percent beginning March 1, while allowing a limited number of imports each year.

According to officials briefed on the negotiations, the arrangement includes an initial quota of 49,000 vehicles during the first year, rising gradually to 70,000 by the fifth year. In exchange, China will lower duties on Canadian canola seed to roughly 15 percent, a long-sought concession for Canadian agriculture. Ottawa argues the revised tariff structure will make EVs priced under $35,000 CAD more accessible, helping accelerate consumer adoption and support emissions goals.

Pushback from Labor Groups and Political Leaders

The announcement has been met with strong resistance from parts of Canada’s auto sector and several political leaders. Ontario Premier Doug Ford blasted the decision, warning it could harm an industry still recovering from recent economic shocks. He also raised concerns about potential cybersecurity issues in vehicles equipped with connected software.

Unifor, the country’s largest private-sector union, issued a sharp statement arguing the deal rewards state-backed pricing strategies from Chinese automakers and jeopardizes the future of domestic manufacturing jobs. Industry groups questioned whether Chinese-built EVs can compete within Canada’s higher-wage labor model, especially as federal and provincial governments continue promoting local production of batteries and EVs.

Mixed Signals from Washington

The United States has responded with unease. Transportation Secretary Sean Duffy said Canada may come to regret the move, while U.S. Trade Representative Jamieson Greer warned the plan undermines coordinated efforts to limit Chinese autos. Several U.S. lawmakers reiterated that China-made EVs remain effectively barred from the U.S. market due to steep tariffs and strict cybersecurity rules governing connected cars.

However, President Donald Trump signaled a notably different position, stating during a White House appearance that Canada was within its rights to pursue negotiations with Beijing. He added that if Canada can strike a favorable trade arrangement, “he should do that,” reflecting Trump’s previously stated openness to Chinese automakers investing directly in the United States.

Consumers and Dealers See Upside

Away from politics, some auto dealers and consumer advocates say the deal could be a turning point in pricing and competition. Dealers who have previewed Chinese EVs at international expos describe rapid improvements in build quality, software integration, and battery performance. Models from brands such as BYD have drawn comparisons to higher-priced rivals already sold in Canada, including long-range crossovers and compact urban EVs.

Advocates for EV adoption argue that greater product variety is essential to accelerate the transition away from gasoline vehicles. Lower-cost EVs are expected to appeal to first-time buyers struggling with sticker prices, potentially boosting overall market penetration. Industry analysts say the consumer segment remains highly price-sensitive, especially among younger buyers and households without access to federal rebates.

Market Outlook and Strategic Positioning

Government sources familiar with the policy say the first wave of imports is likely to consist of vehicles manufactured in China by international automakers with North American or Asian roots, as many Chinese-branded models have not yet completed Transport Canada certification. Ottawa also intends to publish a new automotive strategy next month that emphasizes Canadian-built EVs and domestic battery supply chains.

Longer term, officials believe Chinese companies may choose to partner with or invest in Canadian automakers to establish local production, particularly if the EV market continues to grow and U.S. trade opportunities remain constrained. The opening import quota represents roughly 3 percent of Canada’s current auto market, leaving room for expansion without overwhelming domestic producers.

The move marks another chapter in Canada’s recent effort to broaden its trade portfolio beyond the United States, amid periodic diplomatic and regulatory friction between the two neighbors. Whether the strategy accelerates consumer electrification or introduces new vulnerabilities remains at the center of a debate likely to intensify in the months ahead.

Search Intensifies for Missing Indonesian Surveillance Aircraft Carrying 11 People as authorities expand rescue operations. Read the full story on my blog for detailed updates!